How to Get an Accurate Figure of Earnings Per Share.

Earnings per share, also known as EPS, are crucial for day traders. Without a strong understanding of EPS, traders can find themselves wasting time and money on stocks they shouldn’t be trading. Without knowing how to calculate EPS accurately traders may end up throwing money at stocks that won’t generate a payoff that’s worthwhile.

What is EPS:

Earnings Per Share is simply the number of profits shareholders of a company earn based on how many shares they have, in other words, it’s the percentage of the net profits that are given to outstanding shares of stock.

EPS is the amount of money that shareholders make from the company on a per-share basis. EPS can also help day traders understand whether a company is succeeding or not. Keeping an eye on the company’s EPS can indicate the growth rate of the company, and is a more accurate way of measuring growth than solely looking at their profits themselves.

It’s common for an earnings report to be released each quarter, if the company had a profitable quarter then the EPS will be good, but if it loses money over the period then the EPS will be poor. Quarterly reports are important for the short-term movement of stock, which is common sense; if the company had a bad period or two then traders will invest elsewhere.

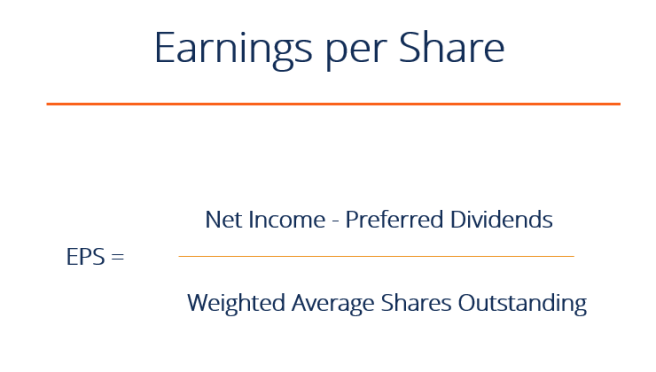

Calculating EPS:

In its most basic sense EPS is the net income divided by outstanding shares.

Earns per share can be calculated by subtracting net profit from preferred dividends and dividing it by the weighted average common sales. To find out the number of outstanding shares, you need to have a look at the company’s balance sheet.

Shares outstanding are all of the shares held by shareholders plus shares owned by investors, this includes the likes of company employees and partners. The end of a balance sheet usually includes shareholders’ equity. Line items such as preferred stock, common stock, and even treasury stock include shares outstanding. Add the shares outstanding for both preferred stock and common stock, if treasury stock is included subtract it from the total, and the end result is the figure of shares outstanding.

i.e : Preferred stock + Common stock = shares outstanding

Or if applicable:

Preferred Stock + Common Stock – Treasury Stock = Shares Outstanding

Unfortunately figuring out the number of shares outstanding isn’t always that simple as the figure can be skewed by the likes of stock splitting or more shares being issued. When this happens you need to calculate the weighted average of shares outstanding for more accurate results.

To work this out you need to multiply the number of outstanding shares by the time of the reporting period the shares were active. The time period is summarized as six months represented as 0.5, three months as 0.25, and so on and so forth. After this, the different sums are added to achieve the weighted average number. For example, 1,000 shares outstanding multiplied by the first six months of the year (0.5) equals 1,000. 500 shares outstanding times the second half of the year equals 250, which means the weighted average is 750.

I.e 1000 x 0.5 = 500

500 x 0.5 = 250

1,000 + 250 = 750 weighted average.

EPS formulas

There are two main formulas that can be used to calculate EPS.

- Net Income ÷ Total Number of Shares Outstanding = Earnings Per Share

- Net Income ÷ Weighted Average of Shares Outstanding = Earnings Per Share

Many day traders prefer the second EPS formula due to its accuracy, as the weighted average takes fluctuations in outstanding shares into account.

There are more factors to consider when working out EPS. Sometimes one company may have the same EPS as another, but that doesn’t mean that both companies are earning the same amount of money. This is why capital is important to take into account as they might not have the same equity. The one with better margins to generate profits is the one worth investing in.

Another thing to take into consideration is basic vs diluted EPS. The formulas above calculate basic EPS, which doesn’t take into account the likes of stock options, warrants, and more that can dilute the EPS. Instances of these examples can reduce the number of outstanding shares. The term EPS usually refers to basic EPS but diluted EPS provides more accurate results. If a company has a total income of $20 million during the financial year with a weighted average of 40 million shares, the net income must be divided by the number of shares.

I.e: 20 ÷ 40 = 0.5.

0.5 equals $0.50.

There’s still more to EPS than the basic and diluted EPS. Smart investors look at a company’s EPS over time to determine whether or not they want to buy shares.

The trailing EPs are the EPS from a previous time period, traders more often than not look at the most recent year that’s passed. This type of EPS is calculated with the real figures from the time period which gives traders a strong idea of the company’s performance in the past, and by extension, they can estimate how they will do in the future.

Current EPS is a projection for the current fiscal year. The current EPS is calculated with the data gathered from the year so far, and the predictions. While Current EPS gives traders a good estimate of how the year will unfold, they need to keep in mind that nothing is set in stone and the company may not perform as predicted.

Forward EPS is further into the future than Current EPS, Current EPS is the estimated earnings for the future.

These three types of EPS should be taken into account when deciding whether or not to invest.

The bottom line

It may take a little extra work to establish the true EPS but it’s a worthwhile move for serious investors. Remember to look at EPS from all angles using the formulas given above to make smart investment choices.