I was terrified a few days ago when I logged into my Capital One 360 Checking Account and noticed some strange transactions. There are two Walmart charges with the description “Debit Card Purchase – Walmart Grocery 8009666546 AR.” These transactions were obviously unauthorized because I’ve never shopped for groceries at Walmart and have had this card for nearly 6 months.

Someone may have stolen my credit card information when I used it a long time ago and is now spending my money. He bought groceries from Walmart so he wouldn’t have to reveal his address. I looked into ways to dispute these transactions, and Capital One’s Online Banking makes it quite simple.

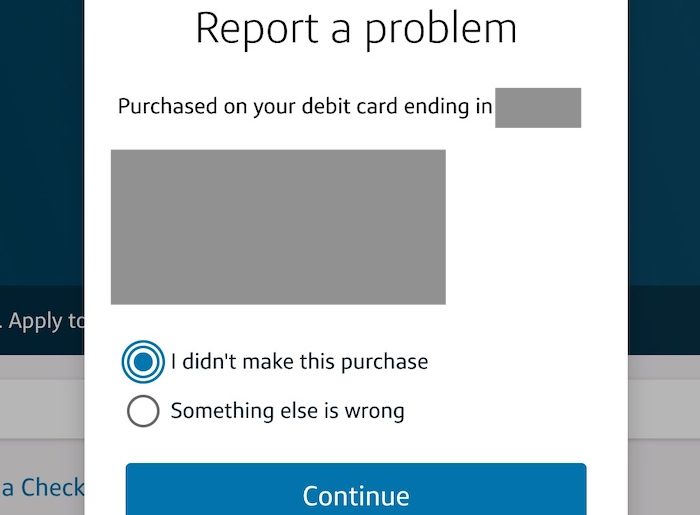

I just went to my checking account, click on the fraudulent transaction to expand it, and click on “Report a Problem” to start a dispute process. Capital One will ask you to confirm you didn’t make this purchase, it is not made by other authorized account users, and is not a subscription or recurring transaction.

After following the instructions, the system automatically disabled my current debit card and mail me a new one. In the meantime, it told me the dispute process had started and I could expect a response within 10 business days.

A few hours later, I received their first system-generated email:

We’re working on the claim you filed for your account ending in **** on */**/2021 for $***.00. Your claim number is ********** and we’ll be in touch when our review is finished. If you have any questions, give us a call at 1-866-536-9023. We’re here 7 days a week from 8 a.m. to 11 p.m. ET

Then they sent another mail after about 10 hours saying they sent me temporary credit:

We’re investigating your disputed transaction(s). In the meantime, we deposited a temporary credit into your account on **/**/2021, for $***.00. This money is immediately available, but may be removed as a result of our investigation.

We’ll also reimburse you for any related interest, finance charges and/or fees within one business day. This reimbursement will be reflected in your account transaction history and on your monthly statement.

We may contact you if we need additional info and we’ll be in touch with the outcome of our investigation.

The law requires card issuers to resolve the dispute within 60 days, so I still need to wait until they complete the investigation to know if I will really receive the refunds. Capital One said that their customers are never held responsible for unauthorized charges with $0 fraud liability, therefore, I am quite confident they could detect the fraud. I will update this post once I receive more responses from the bank.

Update 1: It’s been 5 weeks and I’m still waiting for Capital One’s final decision. The credits I received are just temporary.

Update 2: Finally the dispute has been resolved nearly 2 months later. I received their email saying “Good news! We finished investigating your dispute(s). Any temporary credits we deposited in your account are now permanent, and your dispute has been resolved.”