Who should be responsible for the security of business bank accounts? In 2011, Guardian Analytics published the founding of the Business Banking Trust Study. The results showed that small and medium-sized businesses became the target of sophisticated bank fraud. It was also found that business bank accounts were not protected against losses due to fraud. The results of the report indicated that 56% of businesses experienced bank fraud and, surprisingly, 61% were victimized more than once.

The 2013 Symantec Internet Security Threat Report indicates an increase of 42% in targeted attacks and a 31% increase of all attacks aimed at businesses with less than 250 employees. Phishing sites using a method of sending emails under false names to make it appear that the emails are from someone else other than the true sender, increased by 125%. Fraud can have a devastating effect on any business.

Business bank accounts usually carry larger amounts. Security measures on business bank accounts tend to be stricter. Business owners often demand more universal access to accounts through Internet services and multiple devices. A former U.S. Federal Bureau of Investigation official, Shawn Henry, says that companies can learn from the FBI when it comes to security defenses.

Private companies should bear the responsibility for defending their networks from criminals and attackers. All business bank account frauds are not done by Internet attackers. A good example of online banking fraud done by an employer is Sonya Causer.

Clive Peeters was Australian electrical, computers, kitchens, and white goods retailer with stores in Victoria, Queensland, and Tasmania. In 2009, it was revealed that a payroll manager, Sonya Causer, defrauded the company by falsely inflating the company payroll expense and then using her company’s online banking access to transfer the difference between the actual and reported expense to bank accounts she controlled.

Sonya Causer transferred a staggering amount of $20 million to her bank accounts during the period November 2007 and June 2009. Causer used the money to purchase 43 properties and three vehicles. Mr. Peeters took civil action to have Causer’s assets transferred to him.

Audit partner at Horwath, Peter Sexton, says that businesses used to pay employees with cheques that required two signatures. Mr. Sexton recommends two measures to cut down on the opportunities for fraudulent behavior. One measure should be preventative and the other detective.

Small and medium-sized businesses became the target of sophisticated bank fraud. Business owners often demand more universal access to accounts through Internet services and multiple devices. The FBI says private companies should bear the responsibility for defending their networks from criminals and attackers.

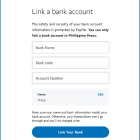

When searching for the best transaction account for you, keep into consideration these factors: ATM access, branch access, Internet banking, and checkbook. Then know the fees which the bank may charge for these facilities, some accounts come as fee-free transaction account.

Article Source: http://EzineArticles.com/8450230